As we embark on a new decade, we want to take a moment and revisit some of the interesting QOMPLX stories from the past 12 months. The year was filled with product innovation, education, information sharing and incredible opportunities to support our customers and partners.

Here's a look at some of the highlights that made headlines in 2019.

Top 25 AI Startups Who Raised the Most Money in 2019

Over $10 billon was invested in AI startups in 2019. The minimum AI startup funding round generated $4M with the average at $14.6M and the maximum, $319M. QOMPLX raised $78.6M from a Series A round on July 23rd. There are many fascinating insights from an analysis of AI startups’ funding rounds in 2019 using Crunchbase Pro research.

Accountability in the Data Supply Chain

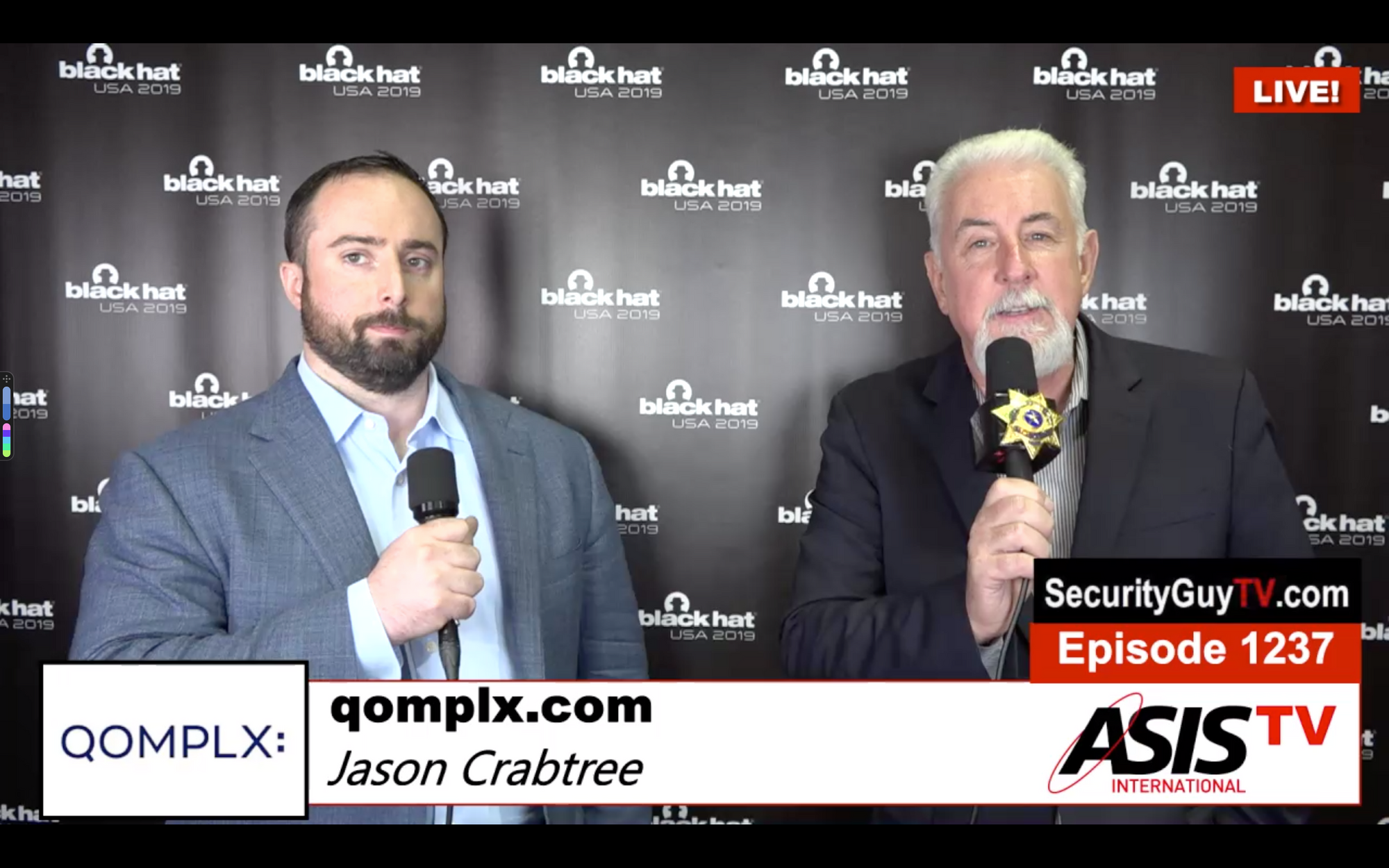

Financial services are increasingly aware of the power of data – but when it comes to leveraging the data needed for maximum benefit, there’s still some way to go. FinTech Alliance talked with Jason Crabtree, QOMPLX's co-founder and CEO, who explains why the core element for managing data, particularly in financial institutions, is authentication.

DoD Eyes New Data Processing Techniques for Battlefield Operations

The Department of Defense is working to discover new ways of storing and leveraging data through aggregation techniques and new technologies like artificial intelligence and machine learning, according to C4ISRnet. John Ferrari, chief administrative officer of software and analytics firm QOMPLX, said at an Association of the U.S. Army event that he expects military assets like tanks to include AI and data processing features in their development requirements within 20 years.

Should the Pentagon Extract, Aggregate or Refine Data?

Before the military can harness data, it helps to understand exactly what kind of resource data is. "Data is like ice,” said John Ferrari, chief administrative officer of QOMPLX, an analytics and insurance software company. “If you put one cube in your glass out on the summer on your patio, it’ll melt. But if you put four bags of ice cubes together around a keg it will stay cold the entire time. Being together makes it exponentially more valuable.” While the ice metaphor may be a stretch, it captures that what makes data useful is its relation to other data: big data is built out of the vast array of connections found when machines process tremendous data sets.

Modern Approaches to Risk Management in a Digital World

How do digital business models enhance and reduce risk? And what do business leaders need to consider as their companies become more digital? Jason Crabtree, QOMPLX CEO and co-founder, joined Charlotte Gribben, Digital Risk lead partner, Deloitte; Emily Jenner, Board member at Airmic, Managing director, global head of risk strategy and appetite Standard Chartered Bank; and Romaney O’Malley, Chief financial officer, AIG UK, to address these key issues.

Forbes 2020 Cybersecurity Predictions

Forbes revealed the crystal balls of key cybersecurity leaders with 141 hot predictions. QOMPLX CISO Andy Jacquith advises that: “The backup and archiving of personal data have been deemed the largest area of privacy risk for 70% of organizations. This stat will continue to grow, and we’ll see improvement in data protection tools across the board, both for discovering what data is available, as well as how it can be protected after it’s identified. The cheapest control is often ignored—simply don’t keep the sensitive data. Companies cannot leak or lose what they do not have. While GDPR and CCPA may be onerous for some to deal with, these regulations will continue to force companies throughout 2020 to instill and build processes that can identify, deduplicate, centralize and most importantly eliminate sensitive data generating a major win for all.”

Reducing Systemic Risk from Cyber Attacks

“Working together to defeat the enemy” and “the need for military precision to combat threat” were the themes for the 2019 P20 Global Payments Conference and sparked a lively discussion. Jason Crabtree, QOMPLX CEO and co-founder, was asked to join the panel of experts and provide important insights into what immediate actions should be implemented.

The Imperative of Reclaiming Metrics Terminology

USENIX, one of the most highly respected communities for engineers, system administrators, scientists, and technicians, published an article that explains in real-world terms why a common set of terms and a robust ontology for cyber security and technology risk is urgently needed to support systemic risk identification, quantification, and management initiatives. Co-authors Dan Geer (Senior Fellow at In-Q-Tel and widely recognized technology security expert and risk management specialist) and Jason Crabtree (CEO and co-founder of QOMPLX), point out that “we are too often speaking past one another—even more so as information technology, business, legal, and other professions collide.”

Using Data to Thrive in a Complex World

Organizations that can win the future are the ones that can navigate this complex interconnected world and distill insight from competing sources of information. D&B invited QOMPLX's Jason Crabtree to The Power of Data podcast to discuss how a unified analytics infrastructure can help inform better decisions.

Analytics Startup Claims to Turn Golden Tickets Brass

A devastating five-year old vulnerability in basic authentication systems may finally have a solution -- but it's really hard. The threat of escalation attacks and forged administration levels has plagued Kerberos authentication systems for years. Data-analytics startup QOMPLX claims to do the math that solves the problem.

QOMPLX Technology Risk Insurance Will Outpace the Security

Technology Risk Insurance will provide a safe platform for users to decelerate risks and costs of technology-related incidents. Cyber-insurance is insurance used to protect businesses and individual users from Internet-based risks but now they are providing poorly defined and narrow incomplete coverage. Dissimilar to Cyber-insurance, QOMPLX Technology Risk Insurance will improve transparency and simplify language for all parties.

Oasis LMF and QOMPLX: Enabling Expert Risk Management with Q:Insurance

The insurance industry is searching for technological advances and broader access to data, automation, and risk intelligence. See why Oasis LMF puts the spotlight on QOMPLX's catastrophic risk modeling and underwriting tools.

Two Military Veterans Raise $78.6 Million for Data-Driven Decision Platform

Jason Crabtree, QOMPLX CEO and Co-founder, spoke with Cheddar Business and tells the story of how he and Andrew Sellers, co-founder and CTO, are re-inventing lessons learned in the military intelligence community to help mission-critical organizations in finance, insurance, banking and utilities/oil and gas integrate a lot of disparate data sources into a unified analytics platform that allows them to operationalize that data to drive better decisions.

Looking Forward

Moving into 2020, we look to the future with much excitement, more technology innovations and more opportunities to help organizations navigate the tremendous complexity of today’s interconnected world with a unified analytics platform that helps them make better decisions faster, with confidence.